INVESTMENT OBJECTIVE

At a General Meeting held on 30 September 2024, Shareholders approved a change in Aquila European Renewables Plc’s (“the Company” or “AER”) Investment Objective and Investment Policy. The new Investment Objective is set out below:

“The Company’s Investment Objective is to realise all existing assets in the Company’s portfolio in an orderly manner.”

INVESTMENT POLICY

The Company will pursue its investment objective by effecting an orderly realisation of its assets in a manner that seeks to achieve a balance for Shareholders between maximising the value received from those assets and making timely returns of capital to Shareholders. This process might include a sale of all of the assets, groups of assets (such as specific geographic or technological portfolios), individual assets of the Company or a combination thereof. The Company will cease to make any new Renewable Energy Infrastructure Investments. Capital expenditure will be permitted where it is deemed necessary or desirable by the Board in connection with the realisation, primarily where such expenditure is necessary to protect or enhance an investment’s realisable value.

Investment Restrictions

The net proceeds from realisations will be used to repay borrowings and make timely returns of capital to Shareholders (net of provisions for the Company’s costs and expenses) in such manner as the Board considers appropriate.

Changes to the Investment Policy

The Directors do not currently intend to propose any material changes to the Company’s Investment Policy. Any material changes to the Company’s Investment Policy set out above will only be made with the approval of the Financial Conduct Authority and the Shareholders by way of an ordinary resolution.

Hedging

The Company does not intend to use hedging or derivatives for investment purposes but may from time to time use derivative instruments such as futures, options, futures contracts and swaps (collectively ‘Derivatives’) to protect the Company from fluctuations of interest rates or electricity prices. The Derivatives must be traded on a regulated market or by private agreement entered into with financial institutions or reputable entities specialising in this type of transaction.

Liquidity Management

The AIFM will ensure a liquidity management system is employed for monitoring the Company’s or its subsidiary, Tesseract Holdings Limited’s (the “Group”) liquidity risks. The AIFM will ensure, on behalf of the Group, that the Group’s liquidity position is consistent at all times with its investment policy, liquidity profile and distribution policy. Any cash received by the Group as part of the realisation process (net of any transaction costs and repayment of borrowings) will be held by the Group as cash on deposit and/or will be invested in cash equivalents, near cash instruments, bearer bonds and money market instruments pending its return to Shareholders.

Borrowing Limits

It is not anticipated that the Company will take on any new borrowings, but may do so for the efficient management of the Company where such borrowings are necessary to protect or enhance an investment’s realizable value as part of the orderly realization of the Company’s assets. At the time of entering into (or acquiring) any new long-term structural debt (including limited recourse debt), total long-term structural debt will not exceed 50 per cent of the prevailing Gross Asset Value. For the avoidance of doubt, in calculating gearing, no account will be taken of any Renewable Energy Infrastructure Investments that are made by the Company by way of a debt or a mezzanine investment. In addition, total short-term debt will be subject to a separate gearing limit so as not to exceed 25 per cent of the Gross Asset Value at the time of entering into (or acquiring) any such short-term debt.

In circumstances where these aforementioned limits are exceeded as a result of gearing of one or more Renewable Energy Infrastructure Investments the Company has a non-controlling interest in, the borrowing restrictions will not be deemed to be breached. However, in such circumstances, the matter will be brought to the attention of the Board who will determine the appropriate course of action.

Dividend Policy

As announced on 13 February 2025, the Board implemented a change in the Company’s future dividend policy. Following the shareholder vote to approve a Managed Wind-Down of the Company, it is the Board’s intention to continue paying dividends covered by earnings and taking into account the Company’s liquidity position, in order to maintain the Company’s investment trust status. As such, the Board will no longer be able to provide forward guidance as to the level of dividend for the year ahead. Shareholders should also note that the Board will no longer seek to smooth the level of dividend over a financial year to reduce the impact of the seasonality of earnings and that, in addition the level of dividend payments are expected to decline as assets are realised (such as Tesla), gearing is reduced and capital is returned to shareholders.

The Company will declare dividends in euros and shareholders will, by default, receive dividend payments in euros. Shareholders may, by completing a dividend election form, elect to receive dividend payments in sterling (at their own exchange-rate risk). The date the exchange rate between euro and sterling is set will be announced when the dividend is declared. A further announcement will be made once the exchange rate has been set. Dividend election forms will be available from the Registrar, Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol BS99 6ZY or by telephone 0370 707 1346.

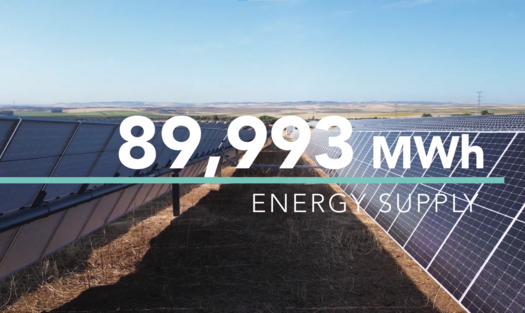

Insights

Our videos feature experts providing insights into investment strategies, current projects as well as ongoing asset management: short, concise and descriptive.